We compare a buy and hold strategy with index ETFs QQQ and SPY vs.our Market Trend Advisory returns. Check out which one had the best return and lowest risk

SPY, QQQ Head & Shoulders: Where the S&P 500 Will Trade in September

ETFs Archives - QUANTITATIVE RESEARCH AND TRADING

/wp-content/uploads/2022/08/how

SPY Archives - QUANTITATIVE RESEARCH AND TRADING

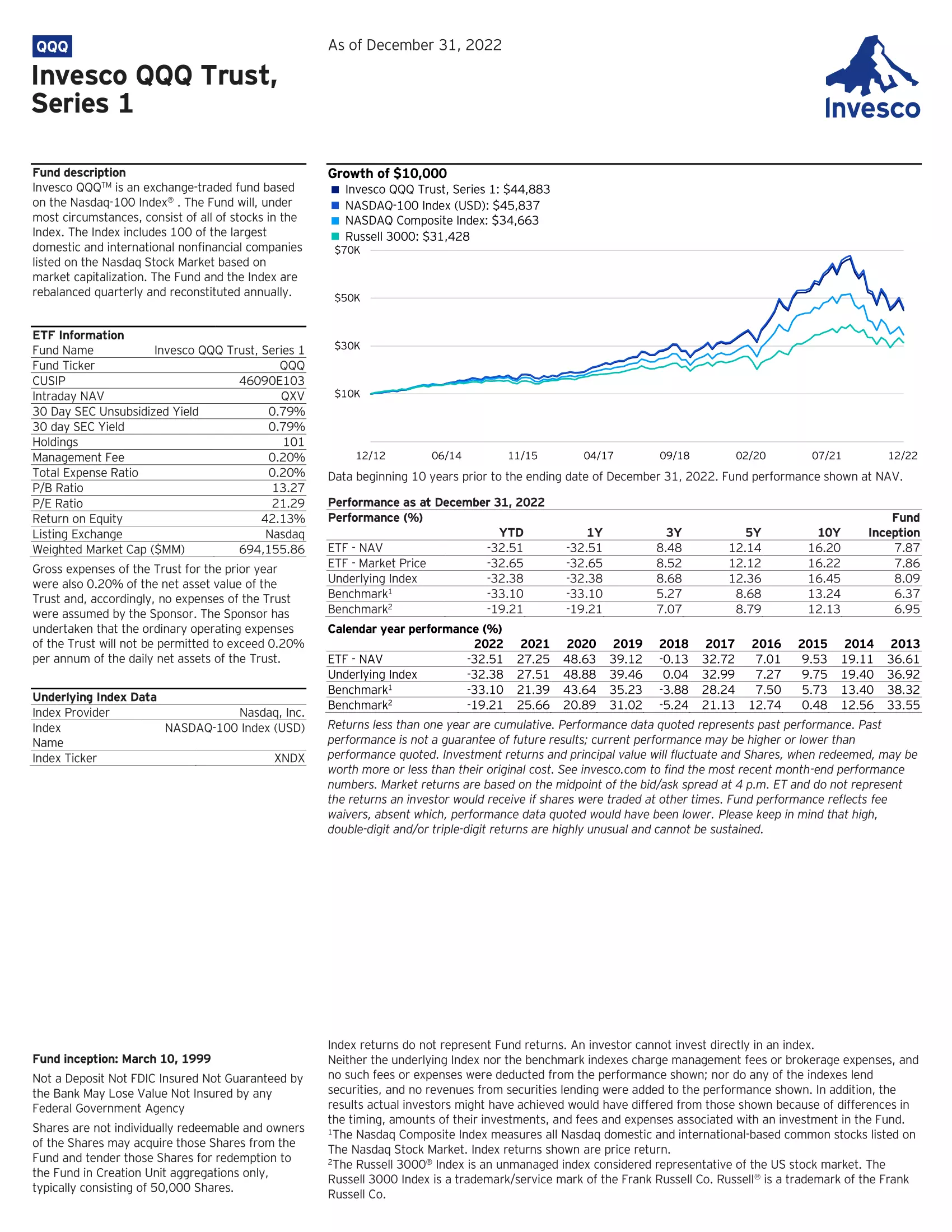

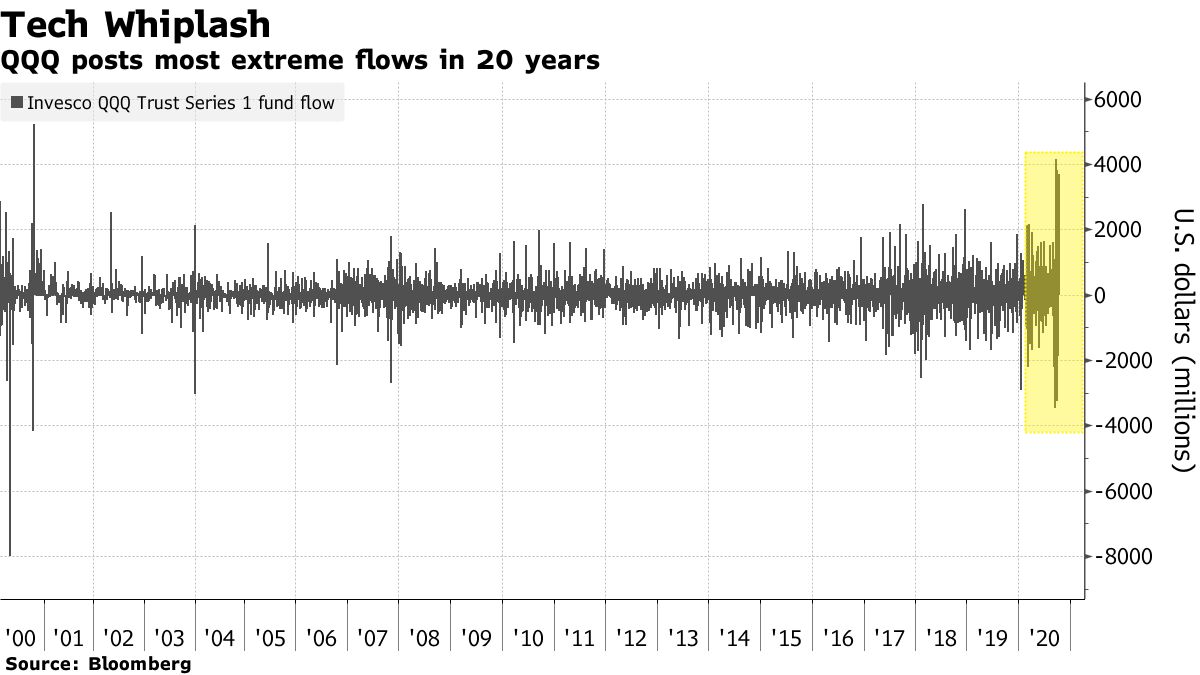

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory

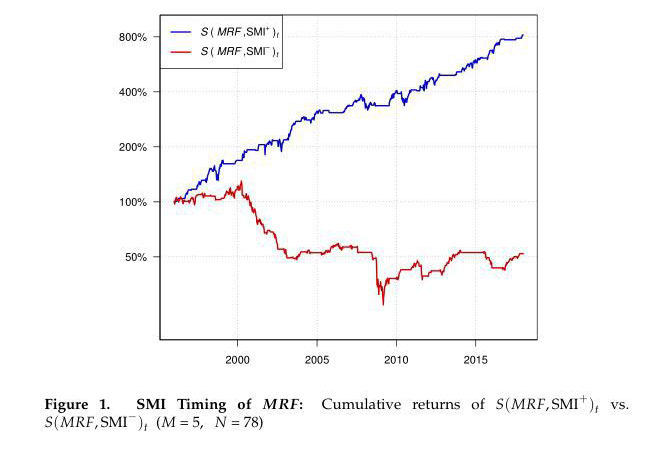

A Revolutionary Approach To Strategy Optimization: The Strategy

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory

The Smart Money Indicator: A New Risk Management Tool

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory

Will Rising Oil Prices Smack the S&P 500? - See It Market

A Case Study: Buy and Hold vs Double-Cost Averaging — Which is

QQQ Vs SPY: Difference, Performance & Which is Better

A Strategy for Trading Options on Index ETFs - Expensivity