Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

How to Start a Nonprofit in Ohio

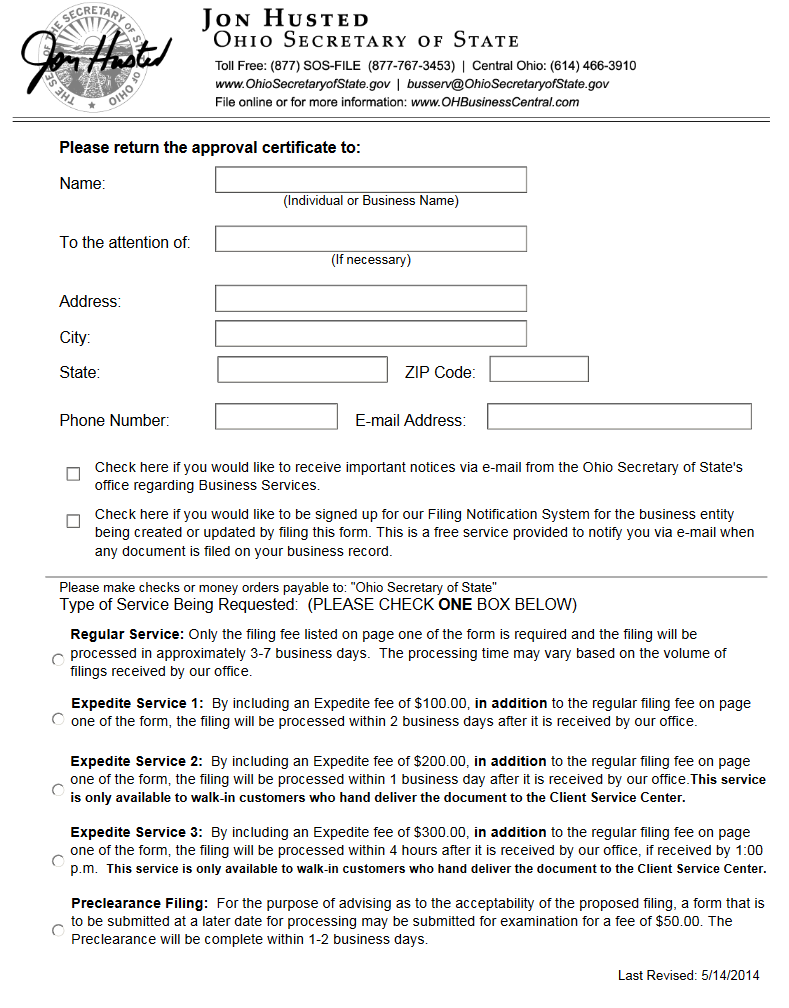

Free Ohio Foreign Nonprofit Corporation Application for License

IT Archive: Military Taxpayer Guide to Taxable Income and Deductions – Oct. 17, 2008

What are Taxable Gross Receipts Under Ohio's Commercial Activity Tax?

Nonprofit LLCs - Tax Law Research : Federal and Ohio - LibGuides at Franklin County Law Library

Starting a Charity in Ohio - CHARITABLE OHIO

THE Foundation #1 NIL for Ohio State

How to fill out a W-9 for a nonprofit corporation

Understanding the Benefits of a Series LLC - Carlile Patchen & Murphy

Income - General Information

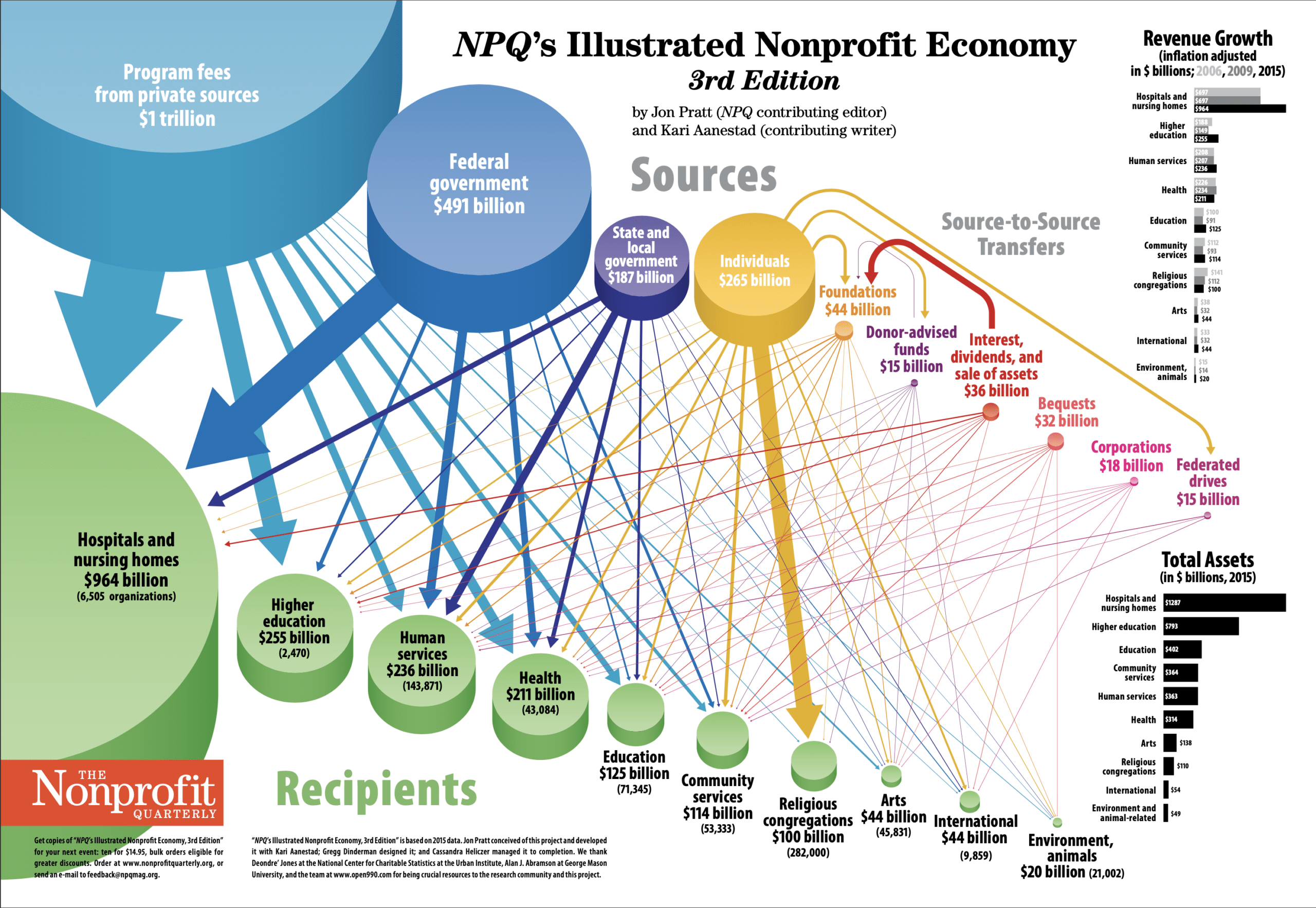

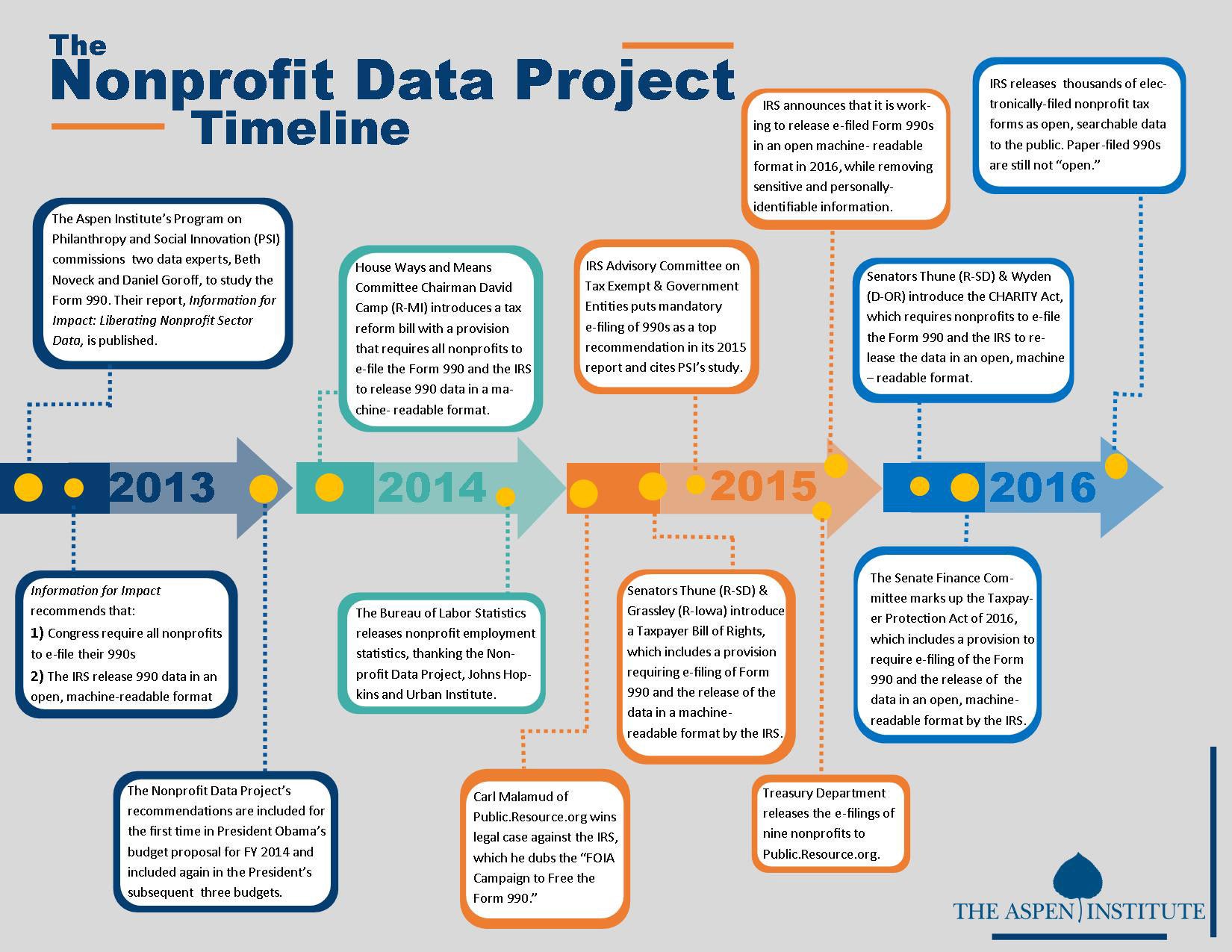

Nonprofit Data Project Updates - The Aspen Institute

Ohio Attorney General Dave Yost - Services for Business

How to Open a Bank Account for a Nonprofit Organization

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)

5 Steps to Forming a 501(c)(3) Nonprofit Corporation

Changes to Ohio's Commercial Activity Tax