Banco do Brasil (BB), Latin America’s largest financial institution, completed its preparations to enter the market for sustainable bonds and has counted, for that, with the support of the Inter-American Development Bank (IDB). The objective is to seek the synergy between BB's experience in financin

Valentina Marquez - Green Bonds - Connectivity Markets and Finance Division (CMF/IFD) - Inter-American Development Bank

IDB Invest, Banco de Bogotá Announce First Sustainable, Subordinated Bond by a Colombian Bank

bbdform20f_2018.htm - Generated by SEC Publisher for SEC Filing

Best Financial Innovations 2023 - Global Finance Magazine

inter-american development bank annual report 2002 by IDB - Issuu

Interview: IDB President

With IDB support, Banco do Brasil qualifies for sustainable bond market

Living with Debt: How to Limit the Risks of Sovereign Finance by IDB - Issuu

Enhancing the credibility of sustainability-linked bonds is pivotal to gaining the acceptance of ESG investors

Calaméo - 4th Global Infrastructure Leadership Forum Book

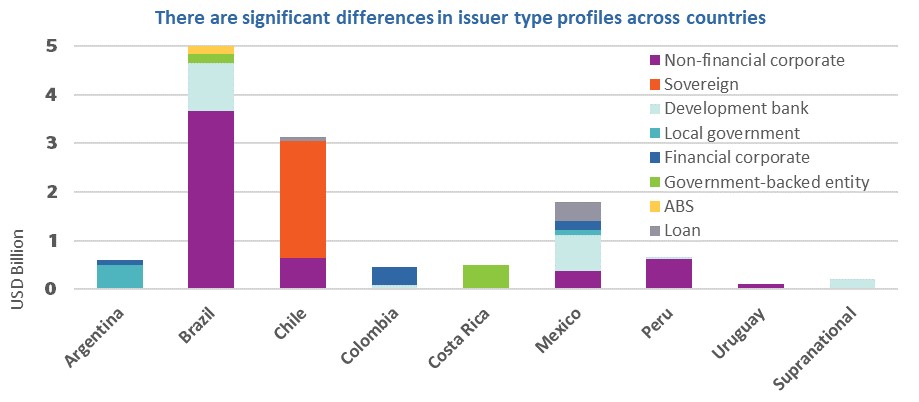

Latin America & Caribbean green finance: Huge potential across the region

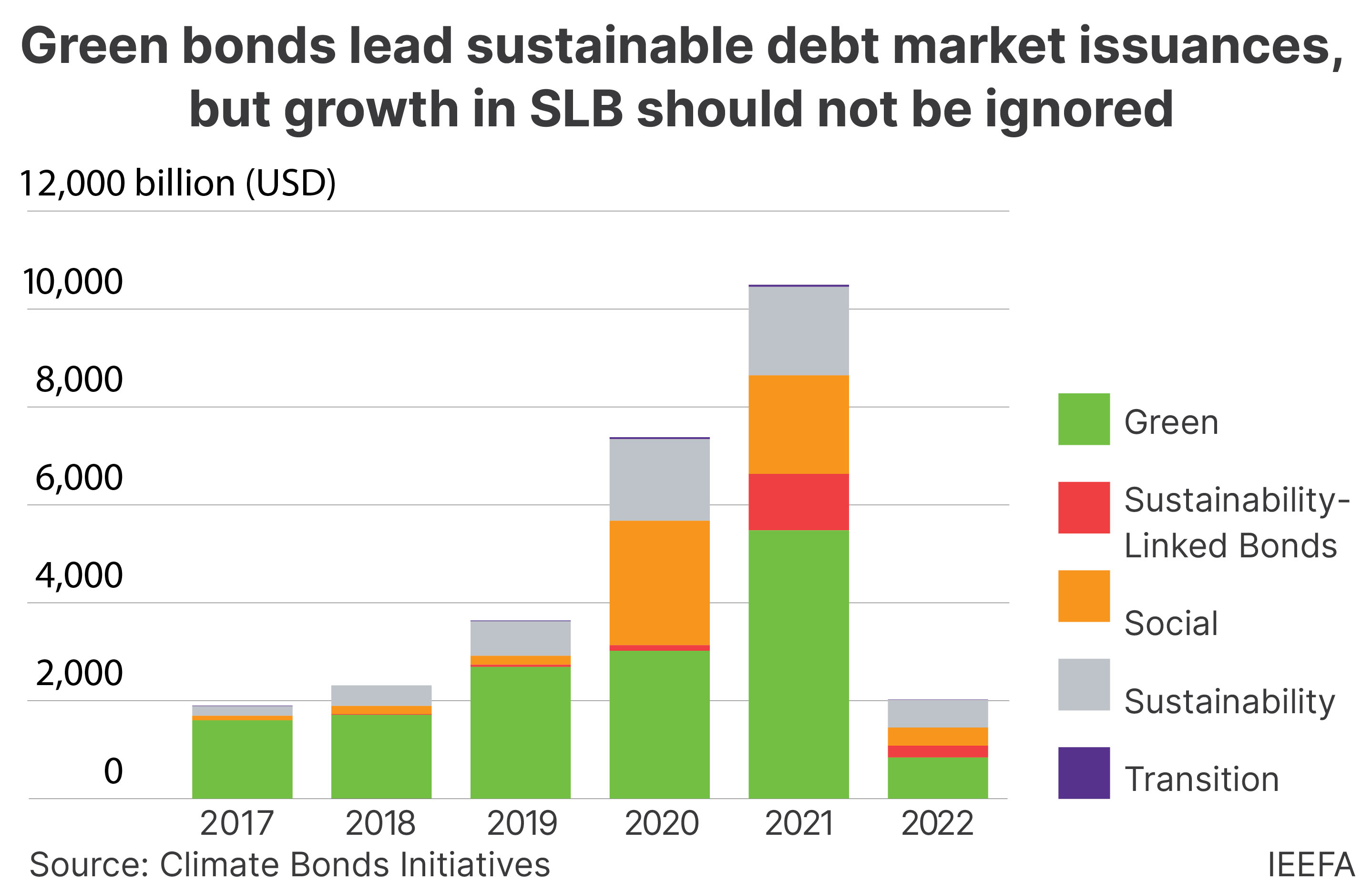

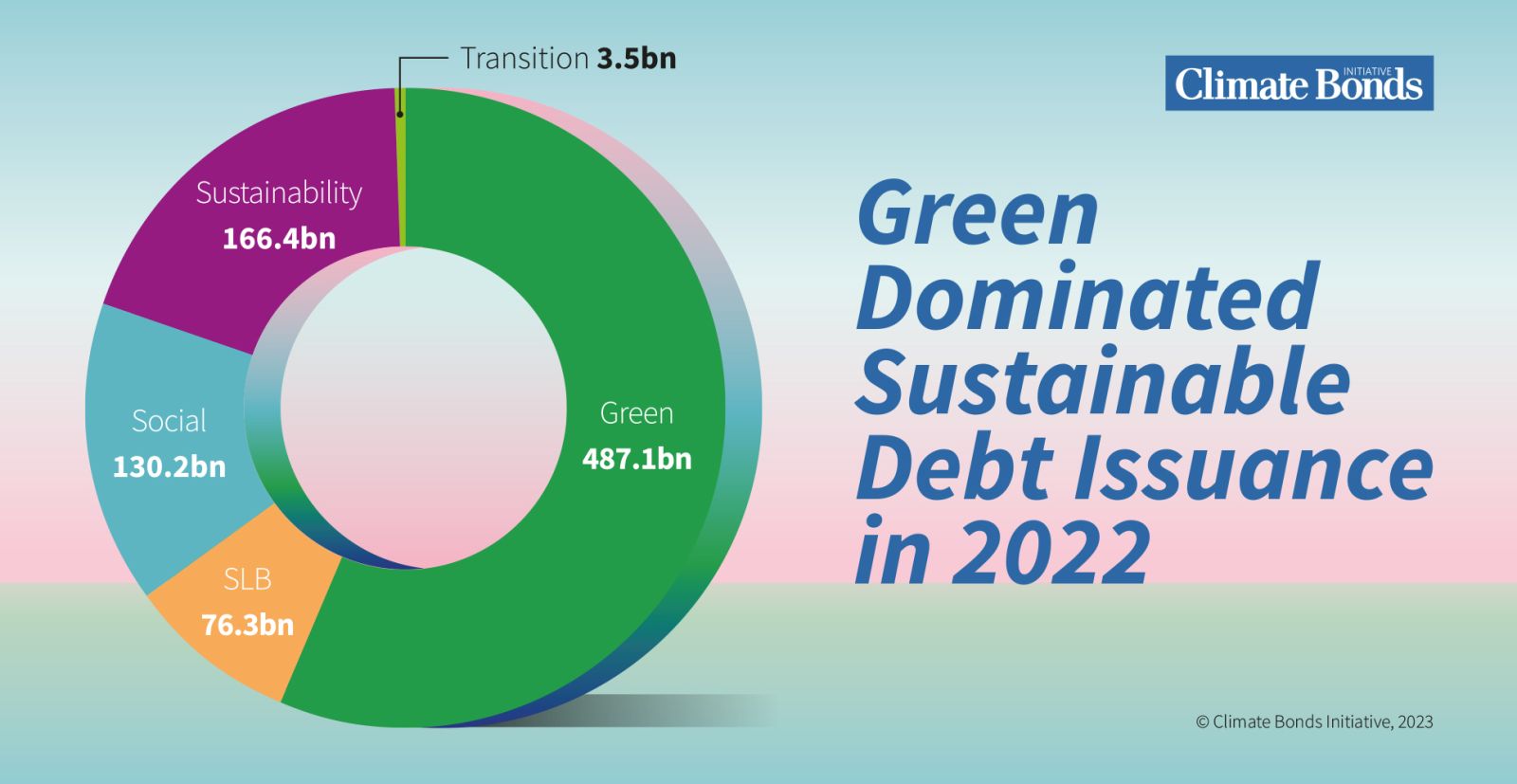

2022 Market Snapshot: And 5 big directions for sustainable finance in 2023

bbdform20f2020_001.jpg

/product/42/4071731/1.jpg?9897)