Description

If you received unemployment compensation during the year, you should receive the 1099-G tax form. If you got the form and didn't receive jobless benefits, you could be the victim of identity theft.

Kentucky tax filing: Confused about your 1099 unemployment form?

Missing A Form 1099? Why You Shouldn't Ask For It

If You Get A 1099-G Form, And You've Never Applied For Unemployment, You May Be A Victim Of Fraud

:max_bytes(150000):strip_icc()/Investopedia-terms-w-9-edit-b52cc61f47044a94aa85d19ccdbeb7af.jpg)

What Is a W-9 Form? Who Can File and How to Fill It Out

1099 vs. W-2: The Difference for Employers

1099-G/1099-INTs Mailed and Available Online

Vermont Department of Taxes Issuing 1099-Gs for Economic Recovery Grants and Taxable Refunds

Unemployment Compensation. Unlike - SHAH CPA FIRM, PLLC

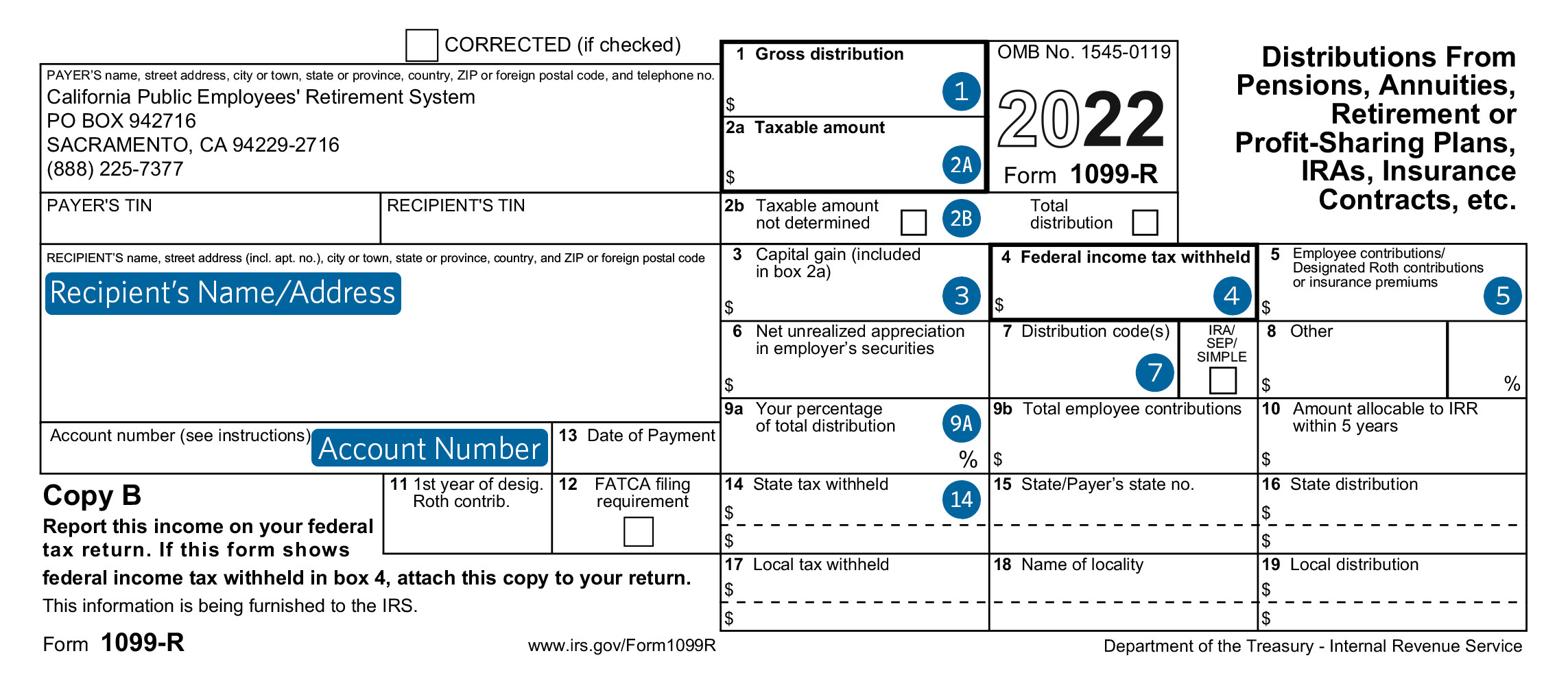

Understanding Your 1099-R Tax Form - CalPERS

Related products

$ 18.99USD

Score 4.8(419)

In stock

Continue to book

$ 18.99USD

Score 4.8(419)

In stock

Continue to book

©2018-2024, farmersprotest.de, Inc. or its affiliates